Experts and elected officials say an extended downturn in oil prices seems unlikely to create the economic disasters that accompanied the 1980s oil bust, because energy-producing states that were left reeling for years have diversified their economies. But…

States that have become accustomed to the benefits of energy production – budgets fattened by oil and gas taxes, ample jobs and healthy rainy-day funds – are now nervously eyeing the changed landscape and wondering how much they will lose from falling prices that have been an unexpected present to drivers across the country this holiday season.

win cash instantly online

“The crunch is coming,” said Gunnar Knapp, a professor of economics and the director of the Institute of Social and Economic Research at the University of Alaska Anchorage.

In Houston, which proudly bills itself as the energy capital of the world, Hercules Offshore announced it would lay off about 300 employees who work on the company’s rigs in the Gulf of Mexico at the end of the month. Texas already lost 2,300 oil and gas jobs in October and November, according to preliminary data released last week by the federal Bureau of Labor Statistics.

In Texas, Fitch Ratings warned that home prices “may be unsustainable” as the price of oil continues to plummet. The American benchmark for crude oil, known as West Texas Intermediate, was $54.73 per barrel on Friday, having fallen from more than $100 a barrel in June.

In Louisiana, the drop in oil prices had a hand in increasing the state’s projected 2015-16 budget shortfall to $1.4 billion and prompting cuts that eliminated 162 vacant positions in state government, reduced contracts across the state and froze expenses for items like travel and supplies at all state agencies. Another round of reductions is expected as soon as January.

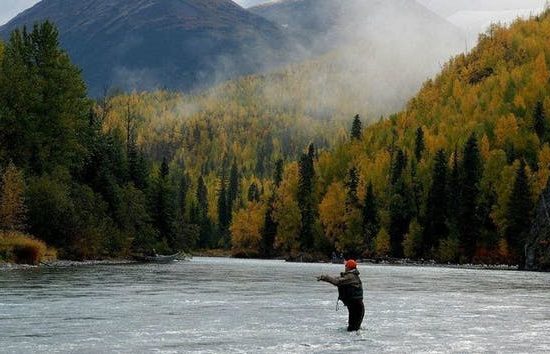

And in Alaska – where about 90 percent of state government is funded by oil, allowing residents to pay no state sales or income taxes – the drop in oil prices has worsened the budget deficit and could force a 50 percent cut in capital spending for bridges and roads. Moody’s, the credit rating service, recently lowered Alaska’s credit outlook from stable to negative.

image credit Star-Ledger File Photo