If you want to know what 2015 has in store for oil prices, just look at where stores of oil ended last year.

U.S. commercial stocks of crude oil and refined products—excluding the roughly 700 million barrels held in the Strategic Petroleum Reserve—were just shy of 1.14 billion barrels at the end of December, according to Energy Department data. More important than the absolute level is what happened to commercial stocks last month: They went up. Refiners tend to run down their tanks as year-end approaches to help minimize tax bills. That stocks rose regardless is a bad sign for those banking on an oil-price rebound.

With OPEC maintaining output, inventories are likely to keep building through at least the first quarter of the year. U.S. output will respond to lower prices by contracting eventually—but that will take time. The Energy Department doesn’t see cuts taking hold until the second half of the year and even then, output for the year as a whole is expected to rise.

U.S. commercial oil inventories are now high enough to cover about 164 days of net imports. That is down slightly from December 2013’s 171 days, yet far higher than the 80 days plumbed at the end of 2007. Moreover, net imports from Canada and Mexico should be excluded from such calculations anyway, since the U.S. is their natural destination. Do this, and commercial stocks cover 279 days of net imports from elsewhere. Add in strategic reserves, and that jumps to almost 450 days.

That is a formidable cushion against any supply shock—and another weight that will sink oil below $50 a barrel in the weeks and months ahead.

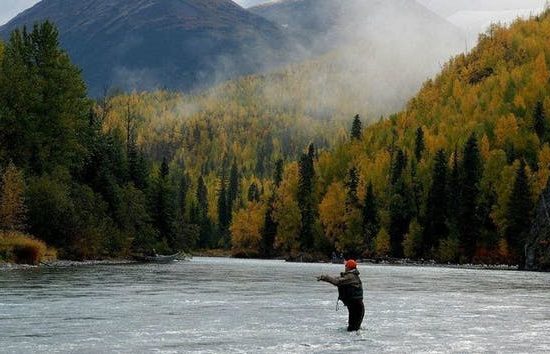

image credit AP photo