Collapsing oil prices have delayed at least two North American liquefied natural gas export projects, but they haven’t stopped Alaska’s massive LNG venture in part because of its size, projected timelines and a partnership involving some of the world’s largest companies, officials said.

“Our mission hasn’t changed, and to my knowledge none of the investing companies are looking to change that at this time either,” said Steve Butt, senior manager for Alaska LNG and an Exxon employee. Butt has referred to the proposal — which comes with an estimated price tag between $45 billion and more than $65 billion — as a “gigaproject,” a supersized megaproject involving the state, Exxon, BP and ConocoPhillips as equity partners.

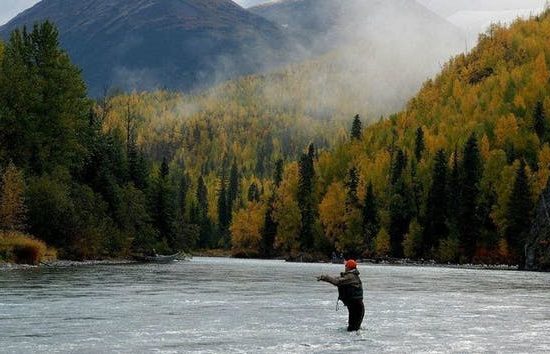

If realized, the project would tap the North Slope’s vast quantities of natural gas, ship it down an 800-mile-long pipeline, super-chill the gas at a Southcentral Alaska plant, then load liquefied gas aboard tankers bound for Asia. With multiple huge facilities to construct, it is a giant among the dozens of LNG export projects being pursued for development in the U.S. and around the world.

Meanwhile, Alaska LNG is still in an early study phase. Officials with each of the equity partners for Alaska LNG told Alaska Dispatch News they are still committed to the project as they were before, with all parties focused on completing the preliminary engineering and design efforts expected to wrap up this year.

A critical decision point comes next year when the companies decide whether they’ll move to more extensive studies in a phase known as front-end engineering and design, or FEED, before they face the final critical decision to invest in 2018 or 2019.

Alaska LNG has other advantages, officials said. Long since discovered, the gas is a known quantity so there’s no exploration risk and expense. The project is closer to Asia than others, reducing transportation costs. And the gas owners can control nearly all aspects of the project, from the gas fields to the docks where tankers are loaded.

Another advantage to Alaska’s project is its equity partners, BP, ConocoPhillips and ExxonMobil, three of the world’s largest companies, said Persily.

See Full Story at ADN.com

image credit