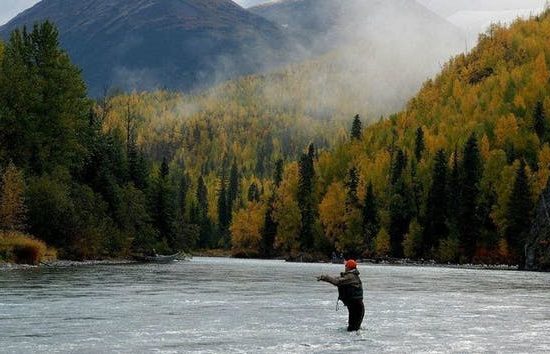

Decades ago, the construction of the Trans Alaska Pipeline (TAPS) transformed the state into a cornerstone to strengthen American energy security, fuel the state’s revenues, propel unparalleled economic growth, and provide job security to thousands of Alaskans. However, Alaska appears to be reaching a turning point in its history.

Today, with the recent downturn in oil prices, Alaska faces a staggering $3.5 billion dollar deficit, up $2.5 billion from what was predicted last year. Oil has been the lifeblood of the Alaska economy, and the Alaska tax base for decades, and for many years it allowed the state to chart its own destiny, free of dependence on the lower 48. But with oil prices continuing to fall, it’s time to diversify and invest again in the future. In 1977 with TAPS, Alaska saw what large infrastructure projects can do for its economy. Now, as researcher Bill White illustrates, the state must do to gas what it did for oil in the 1970s. In the past few years, the state has begun a decade long effort to do just that.

The Alaska LNG project would create a next generation megaproject on the scale of TAPS. In fact, at a cost of up to $65 billion, it represents the largest proposed infrastructure project in North America. In addition to providing new access to natural gas for Alaskans, the pipeline will generate a new revenue stream for the state and help insulate the tax base from the volatility of oil price fluctuations that have recently shocked the market and sent state fiscal reserves plummeting. Current estimates predict between $2 and $3 billion in new state revenues annually from sales from the pipeline.

See Full Story Here

See Feb 11, 2015 AKLNG News Release