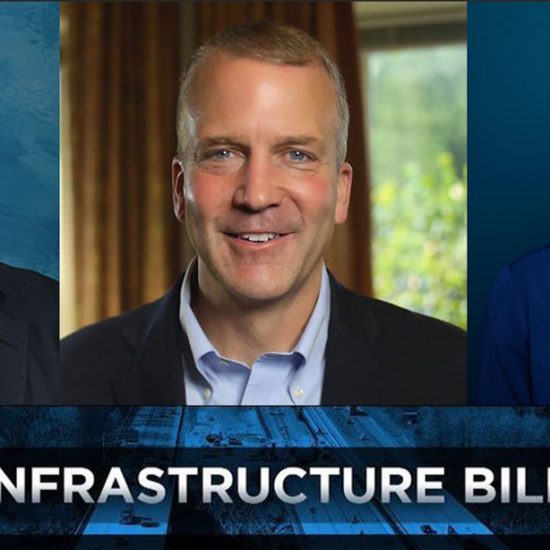

Gov. Bill Walker is proposing a personal state income tax as part of his plan to close Alaska’s $3.5 billion budget gap, he announced Wednesday.

The administration estimates that having a majority of residents pay directly into state government for the first time since 1980 would generate an additional $200 million of state revenue each year. Other elements of the proposal would reduce the size of annual Permanent Fund dividend checks to an initial amount of about $1,000.

Walker borrows a line from Hammond: “I knew this day would arrive. I just didn’t think I’d be the one standing here when it did.” #akgov

Overall, the fiscal plan released by Walker would dramatically broaden the tax base and transform how government is financed, including elimination of some oil and gas tax credits.

“There’s no one who isn’t going to be impacted in some way, by what we’re going to propose,” Walker told reporters in Anchorage.

The proposal by Walker is the first step in what promises to be a contentious public debate and battle with lawmakers on how to overhaul the way Alaska pays for state government and close massive budget gaps created by slumping oil prices.

INCOME TAX: The average Alaskan would pay approximately 1.5 percent of the gross amount they earn. That means someone who earns $100,000 annually before federal taxes would pay roughly $1,500.

PERMANENT FUND: You would still get an annual dividend check, but it would be noticeably smaller – at least in the immediate future. Rather than getting an annual check based on the five-year average of the performance of state financial assets, Alaskans would get a piece of resource royalty payments. Residents received a $2,072 check in 2015. The number would be locked in at $1,000 next year, and would then fluctuate with natural resource markets.

See Full Story at KTUU.com