A minute past midnight, Walker called for legislators to return to Juneau on Monday. He asked them to consider the capital and operating budgets. The special session will also focus on legislation to draw money from Permanent Fund earnings to pay for the annual budget, as well as a bill to overhaul the state’s oil and gas taxes.

A minute past midnight, Walker called for legislators to return to Juneau on Monday. He asked them to consider the capital and operating budgets. The special session will also focus on legislation to draw money from Permanent Fund earnings to pay for the annual budget, as well as a bill to overhaul the state’s oil and gas taxes.

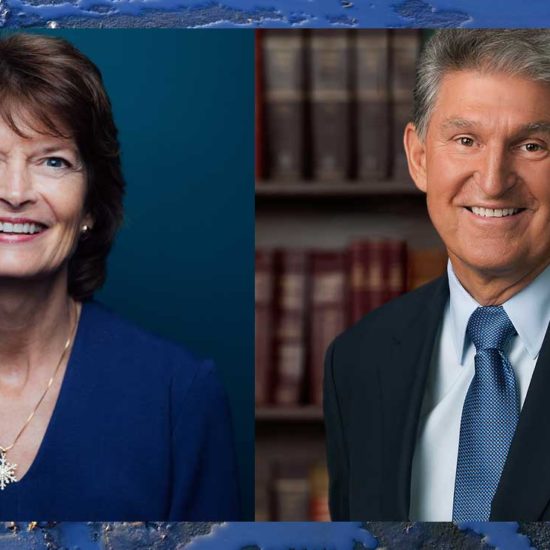

See Full Story at alaskapublic.org thumbnail courtesy @AustinBaird

TEXT OF GOVERNOR BILL WALKER’S CALL:

FOURTH SPECIAL SESSION OF THE TWENTY-NINTH ALASKA STATE LEGISLATURE

Under the authority of Article II, Section 9, and Article III, Section 17, Constitution of the State of Alaska, and in the public interest, I call the Twenty-Ninth Legislature of the State of Alaska into its fourth special session at Juneau, Alaska, on Monday, May 23, 2016, at 11 a.m. to consider the following subjects:

1. HB 256 or a similar act relating to making appropriations for the operating and loan program expenses of state government and for certain programs, capitalizing funds, amending appropriations, repealing appropriations, and making appropriations under Article IX, Section 17(c), Constitution of the State of Alaska, from the constitutional budget reserve fund;

2. HB 257 or a similar act relating to making appropriations for the operating and capital expenses of the state’s integrated comprehensive mental health program;

3. SB 138 or a similar act relating to making appropriations, including capital appropriations, reappropriations, and other appropriations; and making appropriations to capitalize funds;

4. HB 245 or SB 128 or a similar act relating to the Alaska permanent fund and the earnings reserve account for purposes of a sustainable draw; relating to the Alaska Permanent Fund Dividend; and relating to the Alaska Permanent Fund Corporation;

5. HB 247 or a similar act relating to interest applicable to delinquent tax; relating to the oil and gas production tax, tax payments, and credits; relating to exploration incentive credits; relating to refunds for the gas storage facility tax credit, the liquefied natural gas storage facility tax credit, and the qualified in-state oil refinery infrastructure expenditures tax credit; relating to the confidential information status and public record status of information in the possession of the Department of Revenue; relating to oil and gas lease expenditures and production tax credits for municipal entities; requiring a bond or cash deposit with a business license application for an oil or gas business;

6. An act relating to a personal income tax, the motor fuel tax, the excise tax on alcoholic beverages, the mining license tax and fees, the mining exploration incentive tax credit, the fisheries business tax, the fishery resource landing tax, the annual base fee for entry or interim-use permits, the administration and enforcement of the marijuana tax, and relating to refunds to local governments and to taxes on tobacco products;

7. HB 200 or a similar act relating to procedures for a petition or proxy for adoption or guardianship of a child in state custody and related amendments to the court rules;

8. HB 27 or a similar act relating to the duties of the Department of Health and Social Services for permanent placement of a child in need of aid; relating to school placement and transportation for children in foster care and foster care placement, including any related court rule amendments;

9. HB 374 or a similar act relating to funding for a reinsurance program; and relating to an application for a waiver for state innovation for health care insurance; and

10. An act relating to major medical insurance coverage for survivors of peace officers and firefighters under the Public Employee’s Retirement System of Alaska.

Dated this 19th day of May, 2016

Time: 12:01 a.m. gov.alaska.gov (emphasis added)

![Midnight [Sun] Oil](https://i0.wp.com/www.apeonline.org/wp-content/uploads/2022/03/Policy-web.jpg?fit=300%2C250&ssl=1)

![Midnight [Sun] Oil](https://i0.wp.com/www.apeonline.org/wp-content/uploads/2021/04/970x250.png?fit=970%2C250&ssl=1)