Low oil prices have Alaska’s leaders in a state of anxiety, but the investment managers of the Alaska Permanent Fund are responding in their own way, and looking for investments that will allow the fund to take advantage of the global dip in crude costs.

While some are anticipating a rebound in collapsing oil and gas prices, others appear to be anticipating a long period of low oil prices. Some of the fund’s top managers said while Alaska was hurting due to low oil prices, and royalties flowing into the fund have slowed dramatically, that might open up opportunities elsewhere.

In oil-importing countries such as China and India, low oil prices mean a significant boost to their economies as money their citizens once used to pay for gas can now be spent elsewhere.

Lazard Asset Management Director Christian Frei said China has had a period of intense growth and change, but those changes are opening new ways for smart investors to make money. There are big opportunities in public health, Frei said, ranging from sanitation systems to hospitals. “China is hugely under-invested in hospitals,” he said, and investors can help meet growing demand for health care.

China is “trying to learn, or re-learn, capitalism on the fly after abandoning communism” while India is opening its economy after having been “basically socialist” and Russia-leaning in the past, Frei said.

Trustees wanted to know how safe investments made in India and China would be, and Frei acknowledged those country’s legal systems presented challenges. “It’s very hard to enforce contract law in China,” he said. In India, where there is an established British-style justice system, legal issues can take a long time to resolve, he said.

What makes China and India especially attractive for Alaska, compared to other investments, is that they are “inversely correlated” to the permanent fund’s source of revenue, Frei said. When oil prices are down in the $40-a-barrel level, that can add to gross domestic product in China.

India is a more consumption-based economy, he said. It has new opportunities as Indians are becoming tourists, and as its “Bollywood” film industry is exporting movies to other countries.

Via adn.com

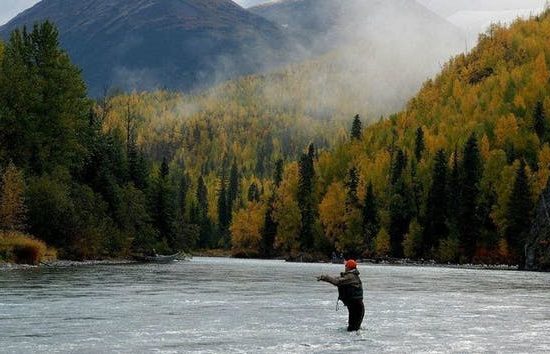

image credit movoto.com